The life insurance industry continues to adjust to the challenges of life insurance in 2025; such as advanced technology, faster underwriting and policy issuance, greater customer expectations, and attracting the upcoming generation. Millennials and Gen Z are becoming key buyers in the life insurance market. These generations prefer digital-first experiences, flexible policies, and transparent pricing.

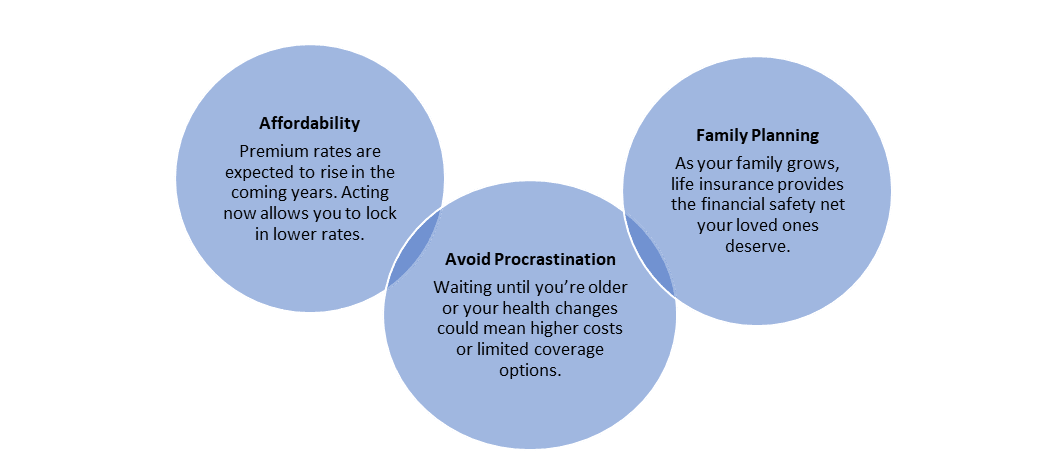

Here are three reasons why 2025 is the year to lock in affordable rates.

Life insurance serves as more than financial protection, it provides peace of mind. As you review life insurance needs for 2025, consider the long-term financial goals. Whether planning for retirement, saving for children’s education, or aiming to leave a legacy, life insurance can play a crucial role in achieving these objectives.

At Wholehan Marketing we are always ready to support our agents through the initial consult, quoting, underwriting, application, submission to placement. We are committed to delivering the best products and customer service possible!

Jody Horetski

Life Insurance Consultant

1.800.535.6080

jody@wholehan.com – www.wholehan.com