According to Financial Planning’s latest Retirement Advisor Confidence Index, a monthly barometer of business conditions for wealth managers, clients are nervous about their retirement situation due to concerns about market valuation, tax changes, and inflation.

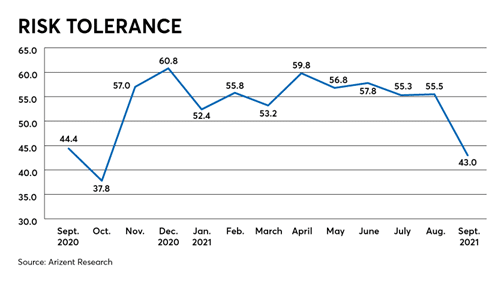

By the numbers, advisors saw their clients pulling back and growing more risk adverse. (See chart below.)

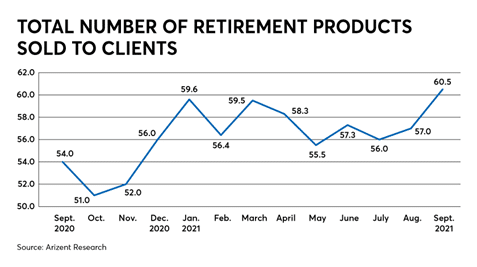

Most advisors in the survey report a flight from equities as clients grow increasingly nervous about tying their nest egg to the stock market and get more conservative. Some advisors are seeing an increase in sales of retirement products as clients question the market.

With this client sentiment It’s a better time than ever to talk your clients through the upside earnings potential and downside protection offered by today’s fixed index annuity contracts. Enhancements such as return of premium, cumulative free withdrawals, uncapped participation rates as high as 210% give your clients more options than ever while 1% trails keep your business model intact.

Call us with your next client that wants to get more conservative for an overview of the best index annuity to meet their needs.